ZeroID is a crypto-based financial platform that offer instant virtual Visa and Mastercard payment cards without KYC (Know Your Customer) verification. The service primarily operates through Telegram and allows users to fund their accounts with cryptocurrencies such as USDT, BTC, and ETH.

Virtual cards are generated within seconds.

Accounts can be topped up directly using major cryptocurrencies.

Cards work globally for online and in-store purchases (where Visa/Mastercard are accepted).

Supports Apple Pay and Google Pay.

Offers enterprise APIs, team card management, white-label solutions, and payment tools for high-risk industries.

ZeroID asserts that it operates within jurisdictions that allow limited-value prepaid cards without traditional KYC procedures. It also claims that funds are held with licensed financial institutions, though these are not FDIC-insured or guaranteed by any deposit protection scheme.

Card Limitations & Conditions

Spending Limits: Daily limits of $500–$2,500 and monthly limits of $5,000–$10,000 (region-dependent).

No ATM Withdrawals: Currently limited to online and contactless payments.

Crypto-Only Funding: No fiat top-ups.

Availability: The service appears to still be in pre-launch or waitlist mode for several regions.

Crypto users

Freelancers & Gig workers

High-risk industries

Digital nomads

Privacy-conscious users

Serving users worldwide, especially in regions where traditional banking falls short European Union

options for better acceptance Tailored for digital nomads Support for high-risk industries United States

Optimized BINs for US merchants Perfect for freelancers and gig workers Turkey & Ukraine

for local merchant compatibility Stable payment solutions in unstable economies Crypto-friendly card options Emerging markets

Virtual cards are issued instantly within the Telegram app. You can start using them immediately for online purchases or add them to Apple Pay/Google Pay.

In an era where billions remain unbanked or under-banked, and digital assets are rapidly migrating into everyday payments, we propose a transformative platform and token ecosystem. Our business is already operational: a full-service cryptocurrency exchange + payment gateway + virtual-card solution, with thousands of users live.

We are now launching two BEP-20 tokens on the BNB Smart Chain:

• zID – the native utility token for our ecosystem;

• USzID – a fiat-pegged stablecoin that supports seamless payments, remittances and merchant gateways.

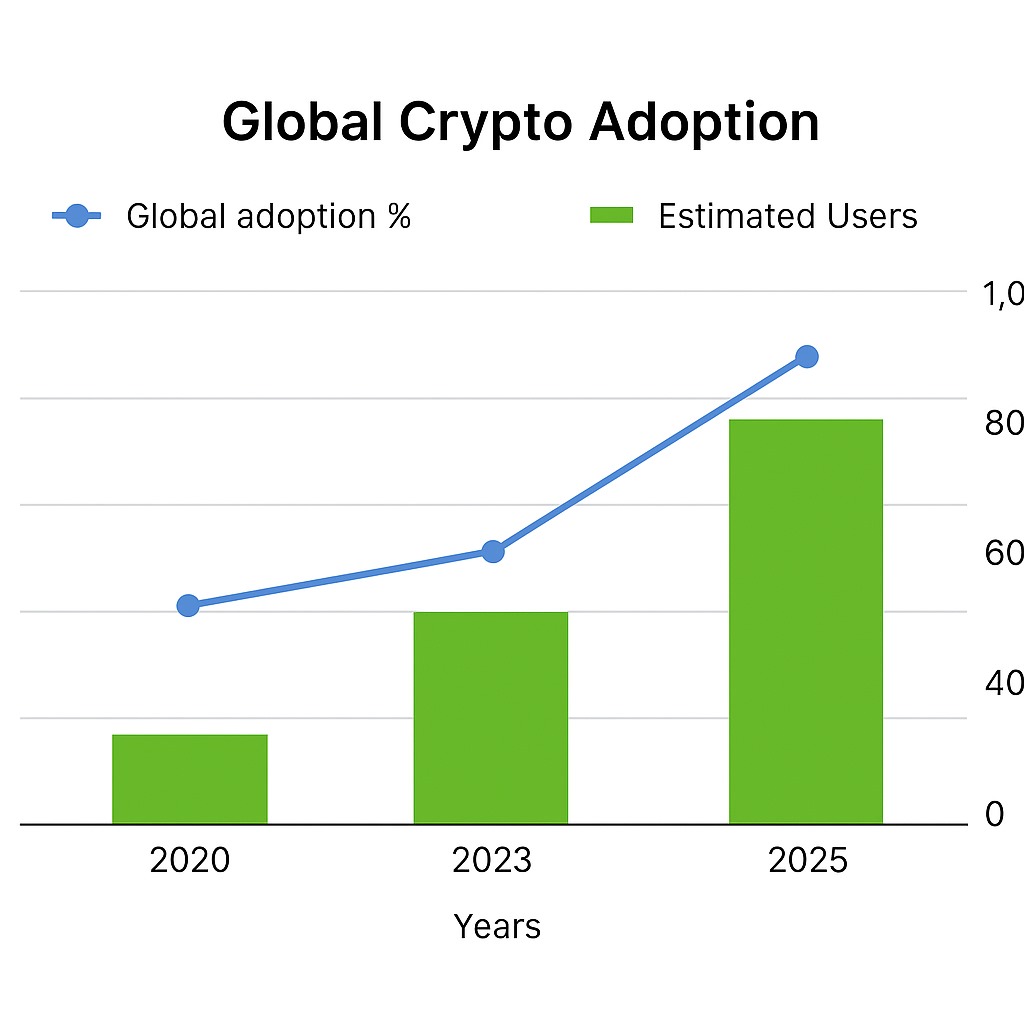

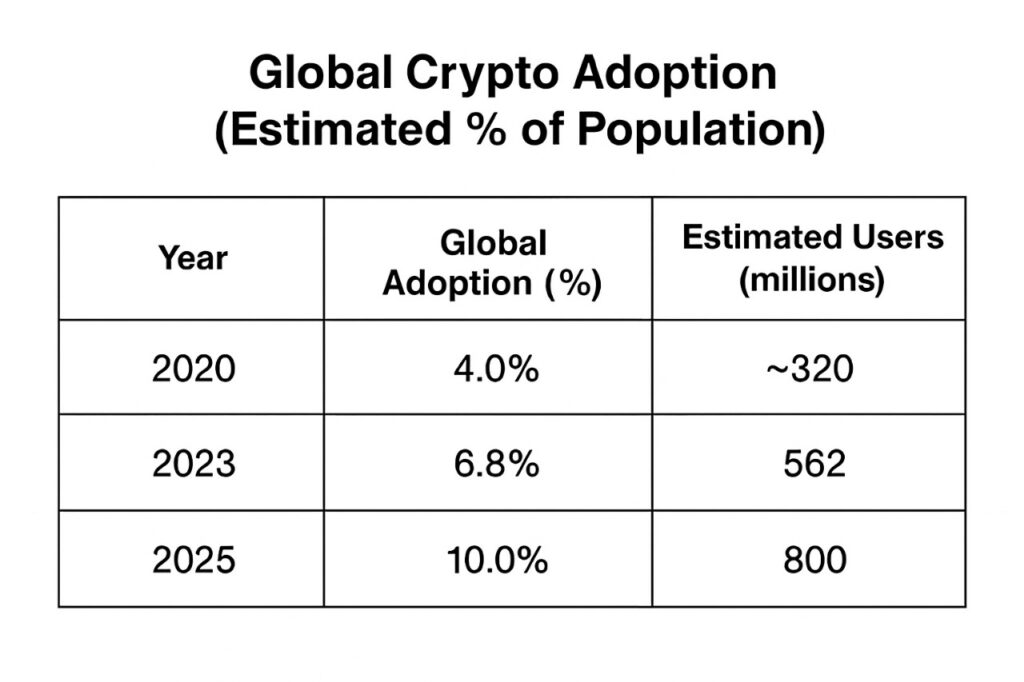

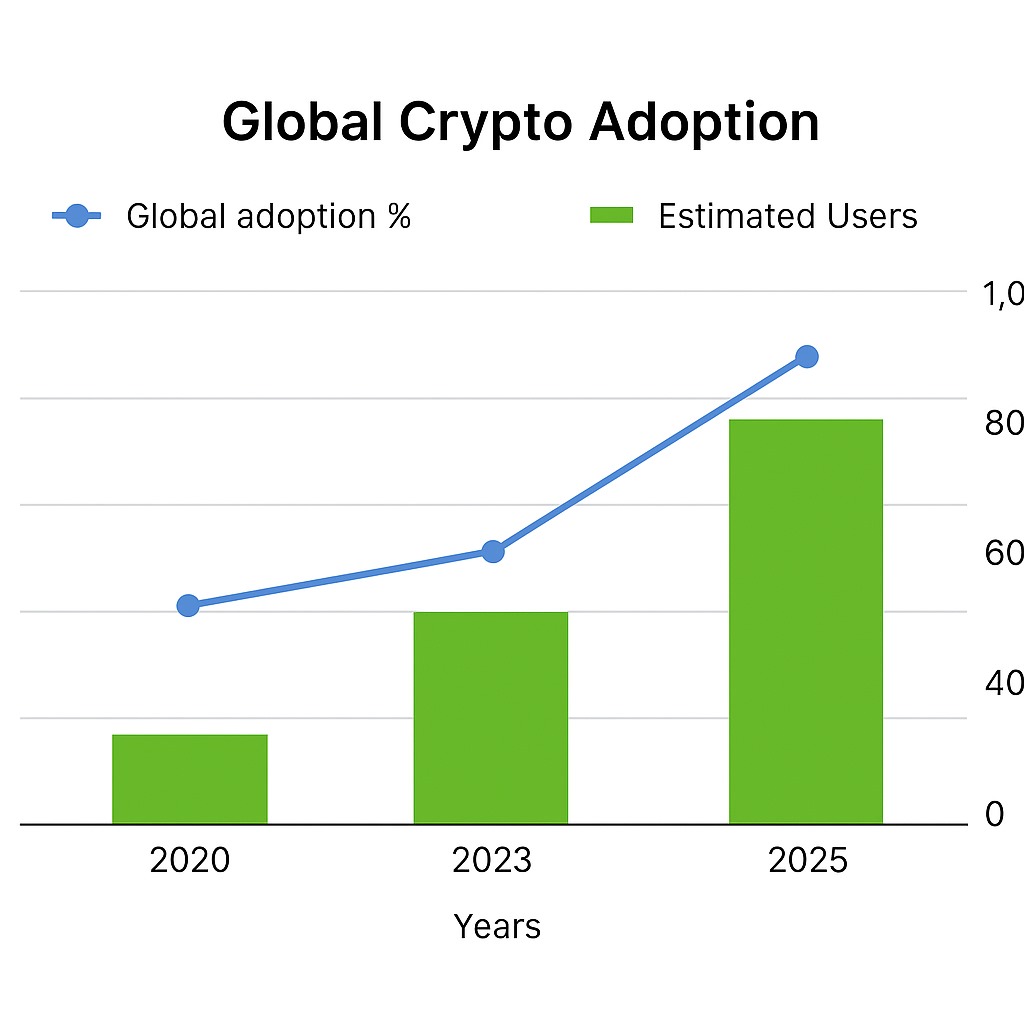

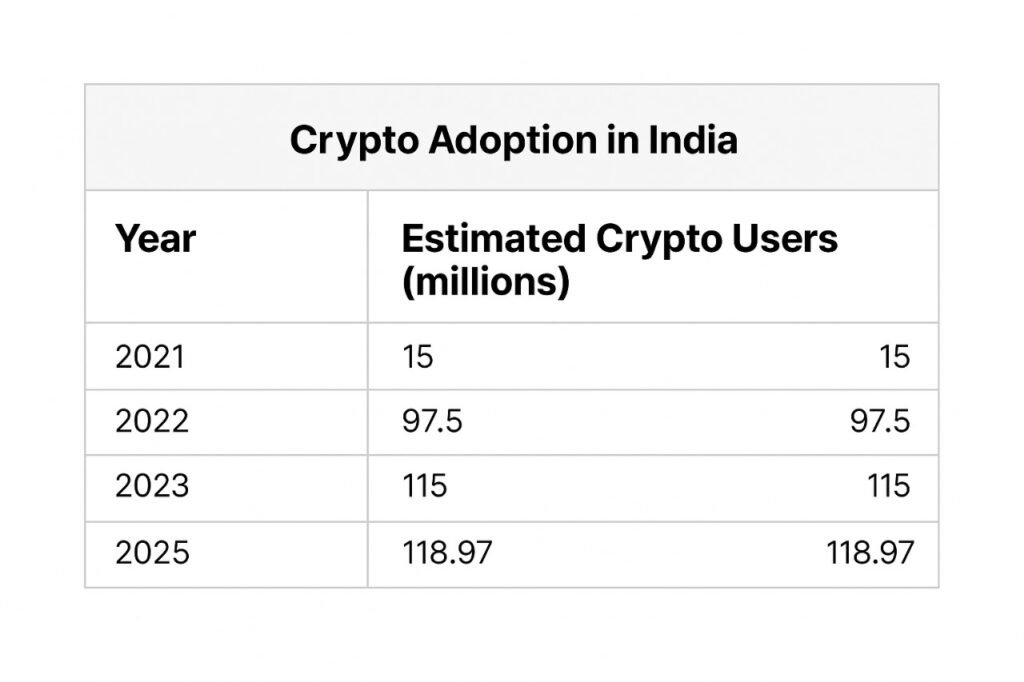

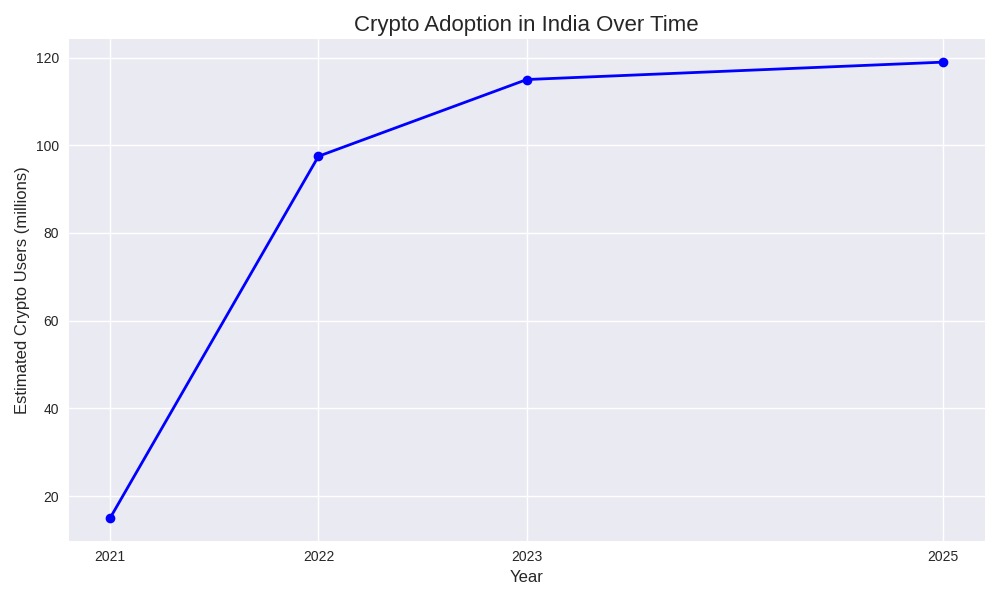

Over the past decade—and especially the past 5 years—cryptocurrency has evolved from an obscure niche into a mainstream financial infrastructure layer. While exact numbers vary, multiple reports indicate hundreds of millions of users worldwide now hold or transact crypto. One source projects that the global crypto user population may approach one billion by 2027. This growth is driven not purely by speculation, but by utility: crypto is being used for payments, remittances, savings, virtual cards, merchant integrations, and as an on-ramp for the unbanked.

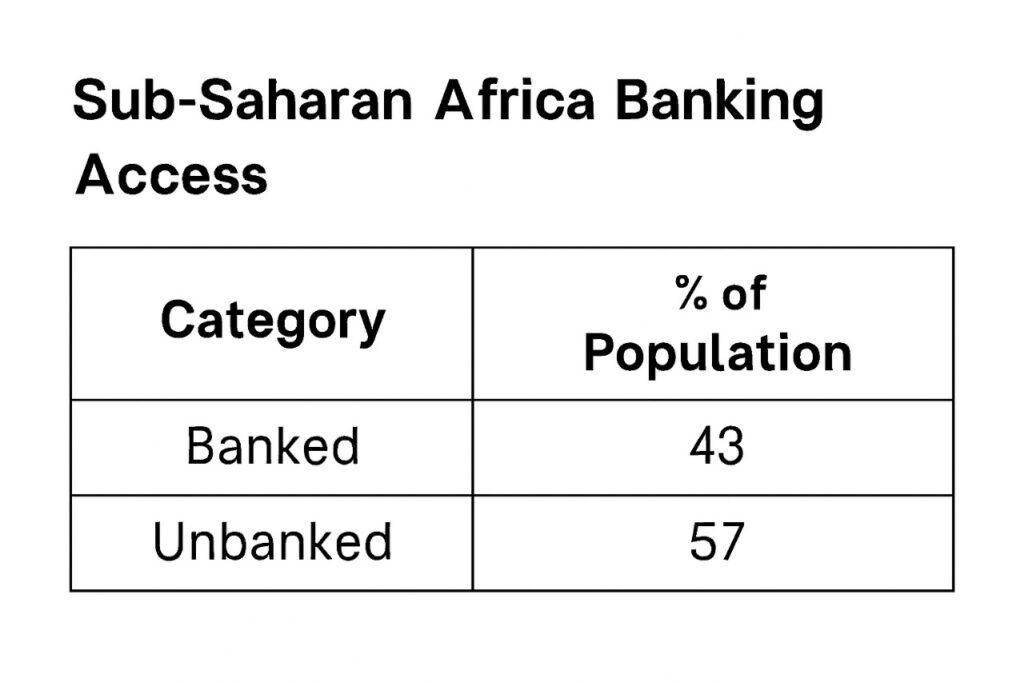

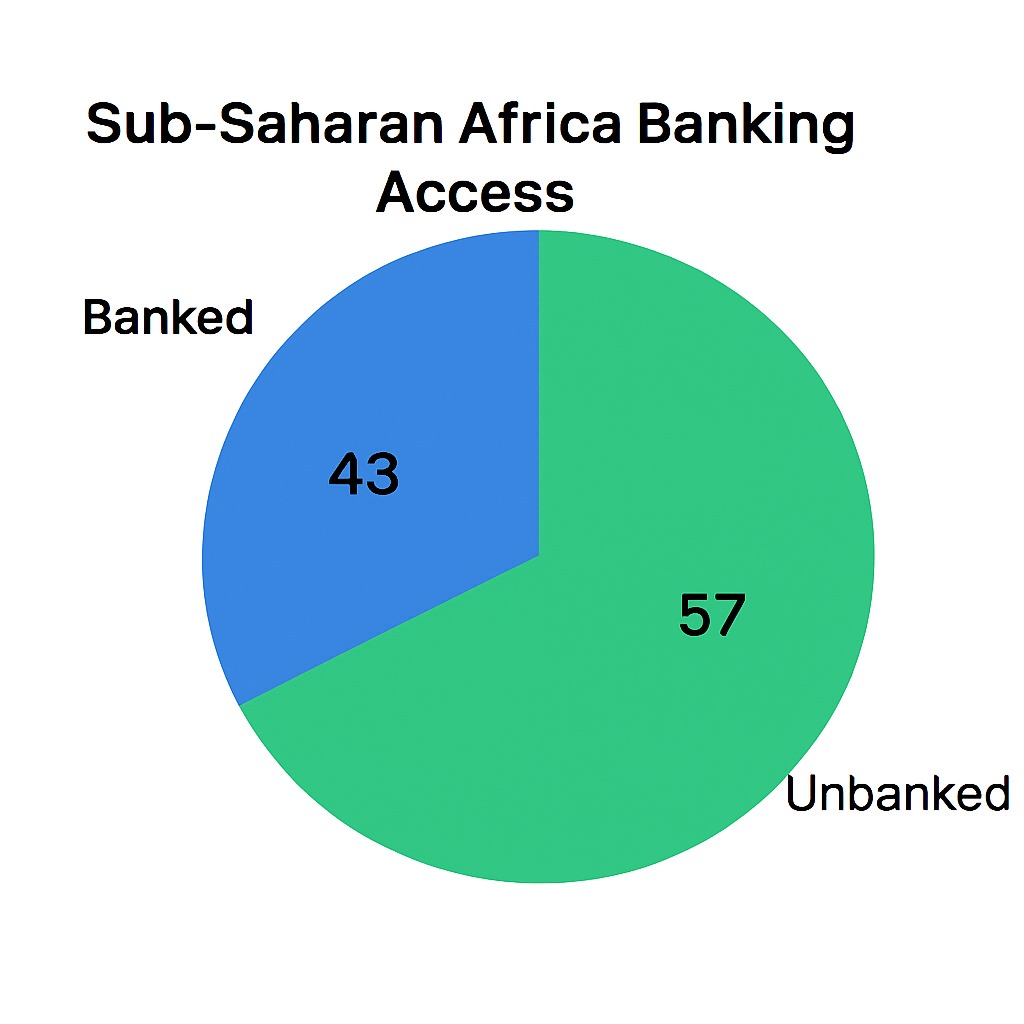

Africa is one of the most compelling growth regions: • Roughly 57 % of adults in sub-Saharan Africa are unbanked. • Between July 2024 and June 2025, sub-Saharan Africa received over US$205 billion in on-chain crypto value, a ~52 % year-on-year increase, making it the third-fastest growing region globally. • The region already uses peer-to-peer crypto flows and stablecoins for real-world payments where banking rails are weak. This creates a fertile environment for a platform that allows mobile sign-up, instant virtual card issuance, crypto + card payments, and merchant integrations — especially for the under-banked and the mobile-first user.

Africa is one of the most compelling growth regions: • Roughly 57 % of adults in sub-Saharan Africa are unbanked. • Between July 2024 and June 2025, sub-Saharan Africa received over US$205 billion in on-chain crypto value, a ~52 % year-on-year increase, making it the third-fastest growing region globally. • The region already uses peer-to-peer crypto flows and stablecoins for real-world payments where banking rails are weak. This creates a fertile environment for a platform that allows mobile sign-up, instant virtual card issuance, crypto + card payments, and merchant integrations — especially for the under-banked and the mobile-first user.

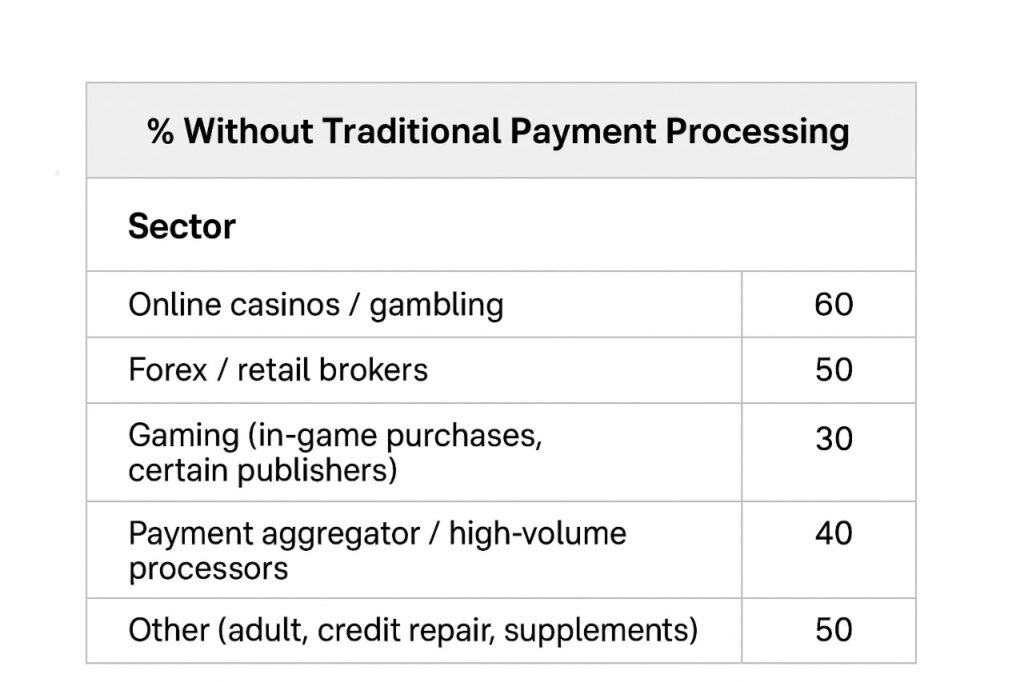

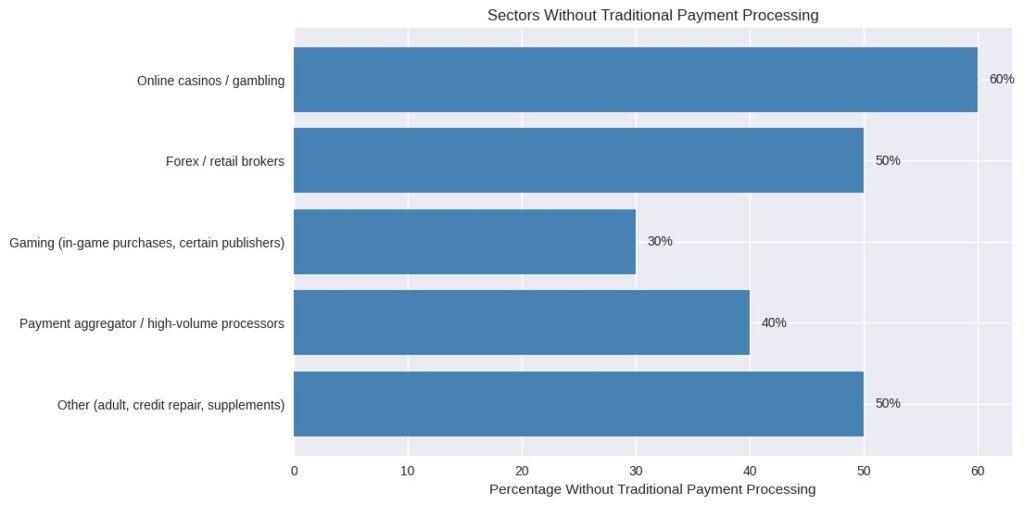

Many regions and merchants remain underserved by traditional banking: • Businesses such as online casinos, Forex brokers, commodities/CFD trading, high-volume card processors often face difficulties obtaining banking/processing. • Unbanked individuals, freelancers, migrants, gig-economy workers and those without full KYC yet needing payment solutions find an opening in crypto-enabled systems. By offering a platform which functions like a “crypto-bank” (wallet, card issuance, crypto + card payments, no KYC required up to defined limits), we complete a missing link in global payments infrastructure.

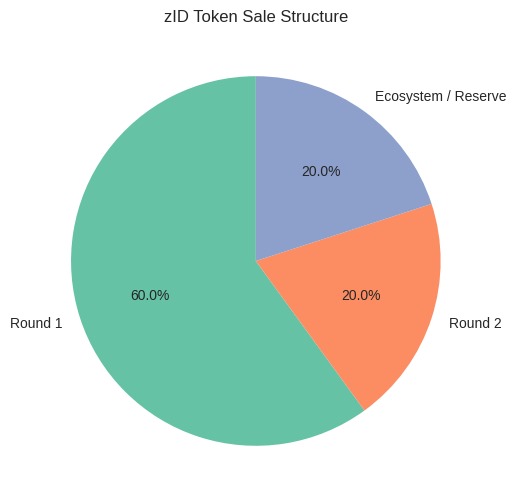

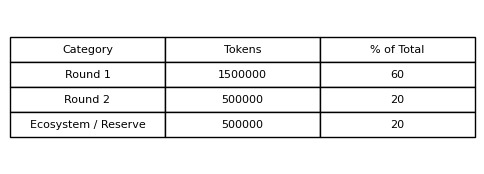

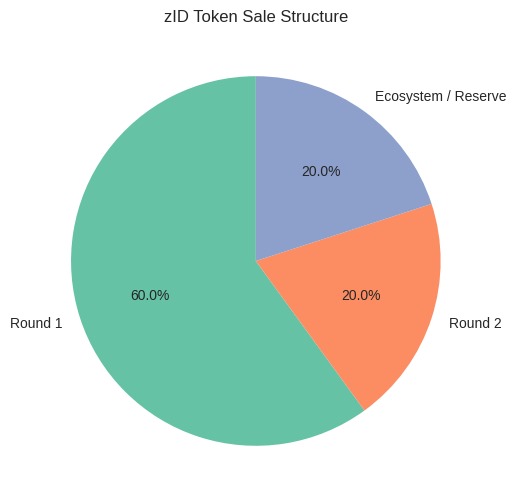

• Token standard: BEP-20 (on BNB Smart Chain)

• Total supply: 2,500,000 zID

• Pre-sale Round 1: 1,500,000 zID

• Pre-sale Round 2: 500,000 zID

• Team allocation: 0 zID (there is no reserve for team tokens)

• Tokenomics: No transaction tax on token transfers (i.e., zero tax for users)

• Utility:

• Discounted fees on exchange/trading/gateway when paying via zID

• Access to premium virtual-card features, higher limits, priority support

• Staking opportunities: users who hold and stake zID earn rewards (from revenue share, future governance rights)

• Merchant incentives: merchants holding/staking zID may get discounted gateway fees, faster settlement, premium integrations

• Governance rights (future roadmap): zID holders will vote on platform upgrades, new features, token-ecosystem changes

• Distribution: to be detailed in the final token allocation schedule (e.g., pre-sale buyers, ecosystem funds, reserves for growth, marketing, partnerships)

• Listing strategy: after both pre-sale rounds, zID will be listed on public token platforms/exchanges for liquidity.

• Token standard: BEP-20 (on BNB Smart Chain)

• Peg: 1 USzID = 1 USD (or equivalent fiat asset value)

• Collateral/backing: The stablecoin will be backed by fiat reserves, or equivalent stable assets, held in audited trust/escrow (details to be published in audit/attestation).

• Role:

• Settlement currency for merchants: merchants can choose to be paid in USzID, which offers stability relative to volatile crypto assets

• Funding the wallet/virtual cards: users may hold USzID in their wallet and spend via virtual card, eliminating volatility concerns

• Remittance corridor: users in emerging markets can receive funds in USzID, hold, convert or spend globally

• On-ramp/off-ramp: easy conversion between fiat/crypto and USzID for user flexibility

• Governance/future: We will introduce transparency reports, periodic audits, and possibly yield-bearing mechanisms for USzID holdings (in collaboration with regulated partners).

• Secure custodial wallet infrastructure (with optional non-custodial features in roadmap)

• KYC-lite onboarding (for initial tiers) with possibility of full KYC for higher limits or merchant accounts

• Card-issuing infrastructure: virtual Visa cards globally, integration with Apple Pay and Google Pay

• Trading engine: support buy/sell crypto with cards, swap between assets, hold wallet balances

• Payment gateway / SDK / widget: easy integration for e-commerce, subscriptions, invoices, merchant dashboards

• Settlement infrastructure: support for BEP-20 assets (zID, USzID and major tokens), fiat settlement rails via partner banking/PSP integrations

• Security: multi-layer security (2FA, device binding, AML/Sanctions screening, cold wallet storage, audits)

• zID and USzID deployed on BNB Smart Chain (BEP-20) for low fees, high throughput, broad ecosystem compatibility

• Transparent token contract, open-source, audited before listing

• zID transfers: no transaction tax, no burn, full utility; USzID: mint/burn mechanism, collateral transparency

• Modular architecture to support additional chains/side-chains in future (if needed)

• API/SDK for third-party integration (wallets, merchant systems, apps)

• Future roadmap to include DeFi integrations (staking, liquidity pools), cross-chain bridges, tokenized assets, and privacy features (optional).

Our platform blends features of:

• Traditional banks/virtual-banks (account creation, cards, payments)

• Cryptocurrency exchanges (buy/sell/swap crypto)

• Payment gateways (merchant widget, card + crypto acceptance)

• Remittance and wallet-services (peer-to-peer payments, cross-border transfers)

But we differentiate by:

1. No KYC (within limits) onboarding in minutes — ideal for under-banked/unbanked populations.

2. Virtual card issuance globally linked to wallet balances including crypto funding.

3. High-risk merchant support (online gaming, forex, brokers) via integrated crypto + card gateway.

4. Token-driven ecosystem (zID) which incentivizes users and merchants to participate and retain value.

5. Stablecoin (USzID) as settlement layer enabling stability, global currency access and bridging fiat/crypto divides.

• Round 1 (private): 1,500,000 zID available for sale

• Round 2 (public): 500,000 zID available for sale

• Total issued: 2,000,000 zID sold in pre-sale rounds; remaining 500,000 reserved for ecosystem development, partnerships, liquidity, marketing

• Pricing, vesting schedule, lock-up terms: to be published in the official token-sale agreement

Proceeds from zID sale will be deployed into:

• Platform development / engineering (wallet, cards, payment gateway)

• Marketing & user acquisition (targeting Africa, Asia, Middle East, Latin America)

• Compliance & licensing (legal, AML/KYC, geographies)

• Liquidity & listing (exchange listings, market-making)

• Partnership & merchant integrations (high-risk verticals)

• Reserve & contingency fund

As with any crypto-token and payments business, risks exist: regulatory risk (licensing, region-specific restrictions), smart-contract risk (bugs/hacks), liquidity risk, market acceptance risk (user adoption), competition risk. Our mitigation strategy includes: audited code, conservative reserves, compliance architecture, scalable platform, and user-growth focus.

The convergence of crypto, payments, virtual cards and under-banked populations creates a very large addressable market. By launching zID (utility token) and USzID (stablecoin) within an already operational exchange/payment-gateway/virtual-card business, we are uniquely positioned to capture value across the entire stack: user onboarding, payments, merchant integrations, card spending, funding flows, token-driven incentives.

Our focus on emerging markets and underserved merchant verticals gives us a competitive edge. The token sale funds will be used to accelerate product development, market expansion and ecosystem growth. We invite you to join us at this inflection point of finance and digital assets.

Don’t miss our future updates! Get Subscribed Today!

©2025.uszid All Rights Reserved.